Business Banking

We are committed to providing our business clients with the banking services and financial tools they need to succeed. Whether you’re just starting out or looking to grow, we offer a variety of accounts, lending options, expert guidance, and customized solutions to help your business prosper.

Trusted advisors to grow your business.

For nearly 120 years, Midwest BankCentre has been providing expert guidance and customized solutions to our clients using in-depth knowledge of their businesses and the regional economy.

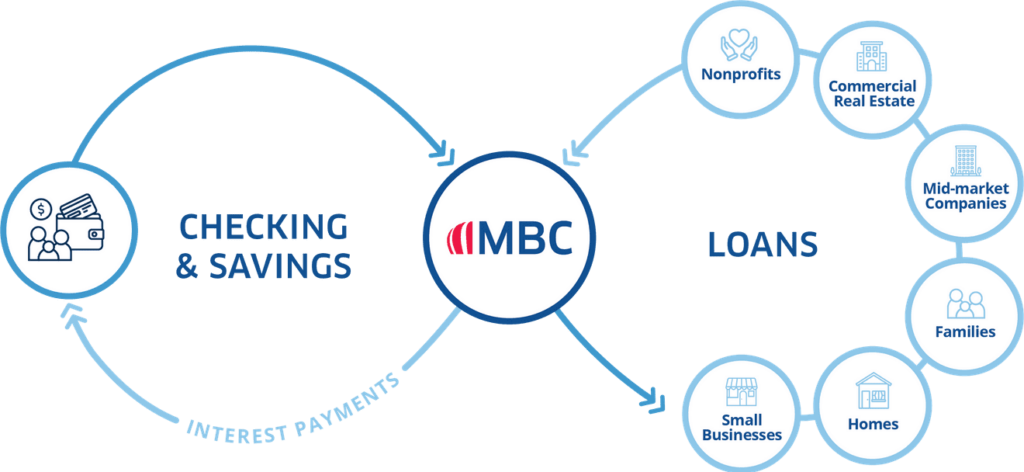

As the Midwest’s premier community bank, we help local businesses like yours achieve their financial goals, while reinvesting deposits right here in the region — so we all RISE TOGETHER.

Business BANKING & treasury management

Explore our business banking & treasury management offerings.

At Midwest BankCentre, we have all the products, services and financial tools your business needs with the personalized service of a local community bank.

Faith-based and nonprofit banking

Amplify your impact.

Discover the power of banking with someone who shares your values. Midwest BankCentre not only understands the unique needs of nonprofits and faith-based organizations, we also serve the same people you serve, often our communities’ most vulnerable. Join the nearly 1,000 local nonprofits that bank their values with us.

Switch Kit

Switching banks? No problem!

Switching banks can seem like a huge chore, but at Midwest BankCentre, we’ve made it easy with our comprehensive Switch Kit.

Designed to streamline the process, our kit provides you with all the tools and guidance you need to transfer your accounts smoothly and efficiently.

Your money achieves more at Midwest BankCentre.

$95 OF EVERY $100 deposited stays in the Midwest, and each dollar circulates six times on average in the regional economy to strengthen local families, businesses, and communities.

We are honored to be recognized for our commitment to local business.

Recognized as Best Small Bank in St. Louis and Best Customer Service by SBM

Also featured in:

Business Banking FAQs

Whether you’re a small business owner, a startup entrepreneur, or managing a growing enterprise, we understand that navigating the world of business banking can be complex. Our goal is to provide clear, concise, and helpful information to ensure you have the support and resources necessary to achieve your financial goals.

If I need help, who can I speak to?

We know you need a responsive banking partner. As our client, you will have a local, dedicated relationship manager.

My business moves quickly, and I need real-time access to my business’s transactions to keep up. How can you help?

In addition to customized offerings, we offer a digital product suite for quick and convenient access to help move your business forward, including e-sign, mobile banking, and mobile payment.

My situation is complex. Can you help?

Let’s talk. We offer customized financial solutions based on garnering a deep understanding of your business and industry and intimate knowledge of our regional economy.

I need a business loan. How do I know which one’s right for my business?

We understand that every situation is different. As your trusted advisor, we can discuss your goals and the pros and cons of different loans to help you determine the business financing option that’s best for you.

Discover the power of banking local.

Join the 10,000+ regional businesses that have chosen personalized service and local decision-making by banking with Midwest BankCentre.