Regularly reviewing your credit report is a crucial aspect of maintaining good credit health. Your credit report contains vital information that lenders use to determine your creditworthiness, so ensuring its accuracy is essential. But how often should you review your credit report? Let’s dive into the importance of regular credit report reviews and the best practices for doing so.

The Importance of Regular Credit Report Reviews

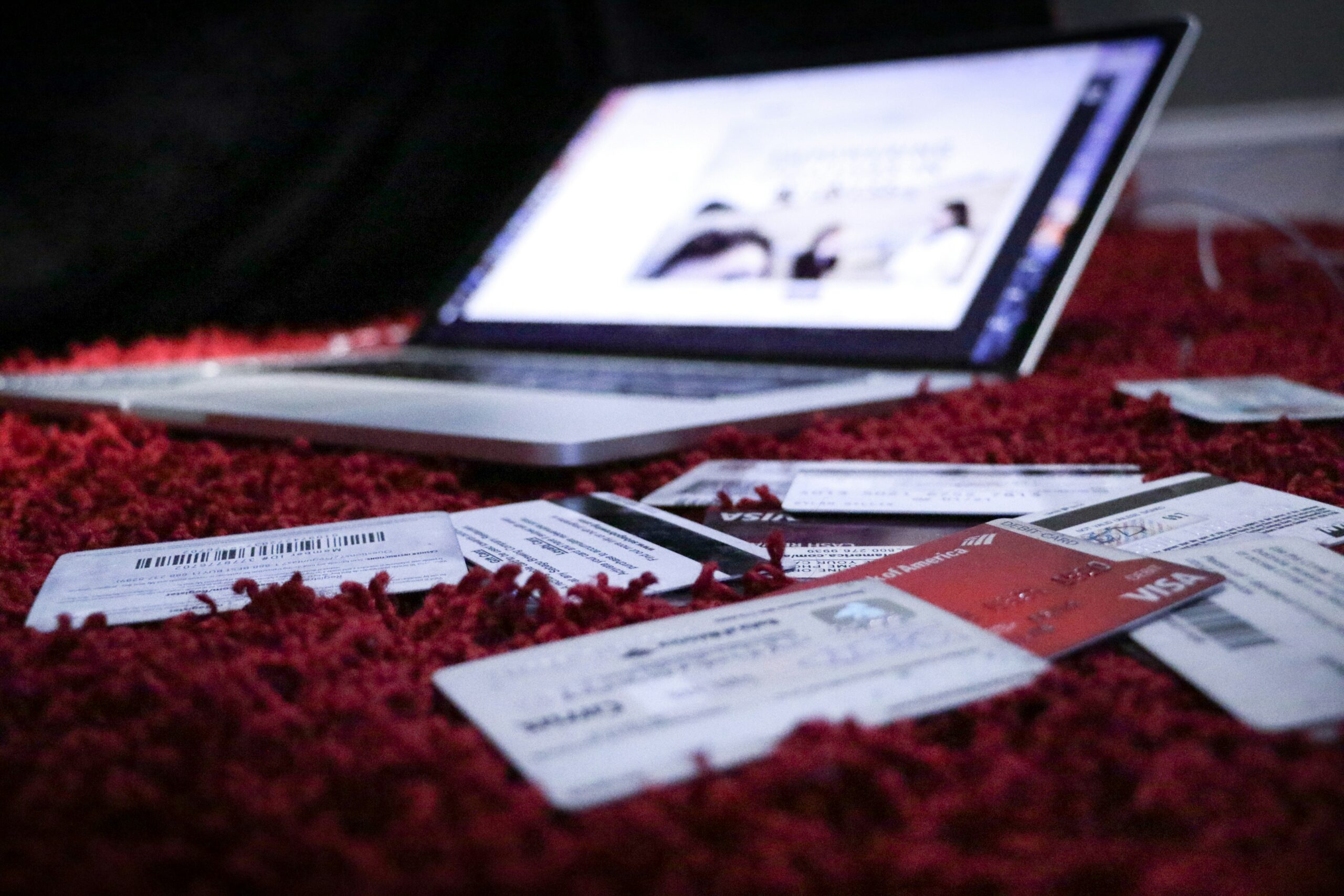

Your credit report is a detailed record of your credit history, including credit accounts, personal loans, credit card debt, and payment history. Regularly reviewing your credit report helps you detect any errors or fraudulent activities early, allowing you to take corrective action promptly. According to the Fair Credit Reporting Act, you are entitled to a free credit report from each of the major credit reporting agencies once a year. However, many financial experts recommend checking your credit report more frequently to stay on top of your credit health.

How Often Should You Review Your Credit Report?

The answer depends on your financial situation and activities. If you are actively managing debt, applying for loans such as FHA home loans, or suspecting identity theft, you may want to review your credit report more frequently, such as quarterly. Using credit monitoring services can also help you keep an eye on your credit activity and receive alerts for any significant changes.

What to Look for in Your Credit Report

When reviewing your credit report, it’s essential to check for any inaccuracies or discrepancies in your credit information. Ensure that all your personal information, such as your name, address, and Social Security number, is correct. Look for any unfamiliar accounts or credit inquiries that you did not initiate, as these could be signs of identity theft. Pay close attention to your credit accounts and ensure that your payment history is accurately reported. Verify that your credit utilization, which is the ratio of your credit card balances to your credit limits, is correctly calculated, as it significantly impacts your credit score. If you find any credit report errors, report them to the respective credit reporting agency immediately.

The Impact of Credit Report Reviews on Your Credit Score

Regularly reviewing your credit report does not negatively impact your credit score. In fact, it can help you maintain a good credit score by allowing you to identify and correct errors promptly. It also helps you monitor your credit utilization and payment history, which are crucial components of credit scoring models. While checking your credit report is a soft inquiry that does not affect your score, applying for new credit accounts or loans results in a hard inquiry, which can slightly lower your score. Therefore, it’s essential to manage your credit inquiries wisely and ensure that any new credit activity is accurately reflected in your credit reports.

Taking Action on Your Credit Report

After reviewing your credit report, take proactive steps to maintain or improve your credit health. If you identify any errors, dispute them with the relevant credit bureau to have them corrected. Monitor your credit utilization by keeping your credit card balances low relative to your credit limits. Make timely payments on all your credit accounts, including credit cards, auto loans, and student loans, to build a positive payment history. By staying vigilant and proactive, you can ensure a smooth credit journey and maintain a good credit score.

In conclusion, regularly reviewing your credit report is essential for maintaining good credit health and preventing potential issues. Aim to review your credit report at least three times a year, or more frequently if needed, and take immediate action to correct any inaccuracies. By doing so, you can ensure that your credit information is accurate and up-to-date, which is crucial for securing the best financial products and achieving your personal finance goals.