Impact Banking

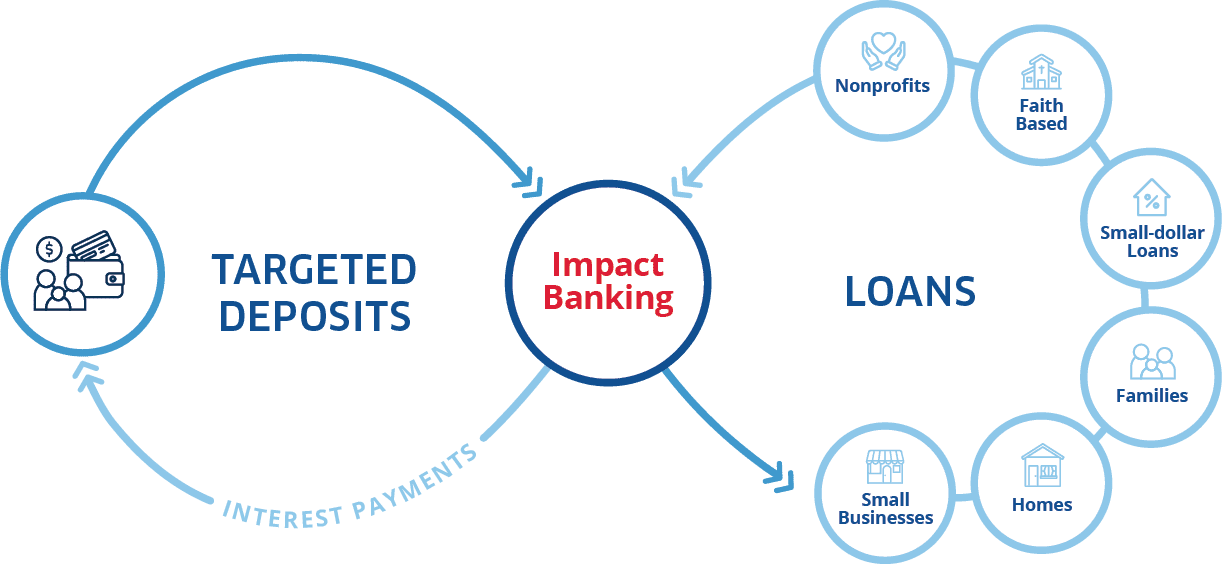

Impact Banking creates a virtuous loop that has the power to transform our region. It begins when anchor institutions, investors, and individuals deposit capital in locally owned, locally focused banks that are committed to Shared Prosperity. The banks in turn invest more in underserved areas to create opportunities for families to buy homes, start or scale businesses, and invest in education.

Every dollar circulates 6x in our regional economy.

Impact Banking creates a shared risk model. Depositors choose to accept a bit less financial return to allow community-focused banks like Midwest BankCentre to take on a bit more risk in extending capital to the most under-resourced.

Impact Banking Transforms Lives and Communities.

Meet Pastors Ken and Beverly Jenkins of the Refuge & Restoration church and nonprofit in Dellwood, a historically disinvested city in North St. Louis County. They partnered with Midwest BankCentre to open the R&R Marketplace, a community center designed to empower residents and promote economic mobility. Impact Banking with Midwest BankCentre makes transformative developments like this possible.

Support for Impact Banking from Local Leaders

The Three Pillars of Impact Banking:

Furthering client prosperity

by improving the financial health

of individual and business clients

and extending banking services

to the financially excluded.

Fueling the growth of our region’s economy

by moving beyond individual transactions to proactively finance and strengthen entire communities.

Financing solutions to societal challenges

by placing capital in

high-impact investments.

$200 Million Commitment

In early 2021, Midwest BankCentre made a commitment to lend an incremental $200 million to nonprofits, faith-based institutions, community development projects, and small businesses in or benefiting historically disinvested neighborhoods over the next five years. We invest a considerable amount of time and resources working through challenges that unfortunately aren’t just surface-level complexities. They are deeply rooted, systemically rooted, with the result being the exclusion of individuals and communities from accessing reasonably priced capital.

To reach its original commitment of an incremental $200 million in loans, Midwest BankCentre will need to originate a total of $495 million over the five-year period. We are proud that we are successfully tracking to our goal and are being responsibly transparent with our stakeholders about our successes, as well as the systemic challenges that we continue to face in helping more people in these communities gain access to opportunity and reasonably priced capital.”

A message from our CEO.

Orvin Kimbrough, Chairman and CEO of Midwest BankCentre, believes there is a strong will to revitalize our region. Through the lens of Impact Banking, he sees a way forward. It requires community banks to be hyper-focused on making meaningful, long-term investments in communities that will lift more people up. It requires rethinking ROI in terms of both financial AND social returns to be transformative. It requires partnerships with anchor institutions, investors, and individuals to unleash the power of the capitalism and scalable capital to the benefit of all.

Impact Banking in The News

Read how BJC HealthCare partnered with MBC to address a historic lack of investment in the City of St. Louis and north St. Louis County.

Discover how BJC HealthCare financially invested more in the community by leveraging its balance sheet and partnered with MBC.

Learn how BJC HealthCare’s equity plan focuses on nutritional, maternal, and economic health.

Find how BJC HealthCare, and Midwest BankCentre, are working together to improve the health of the community by addressing a lack of investment in the city of St. Louis and north St. Louis County.

Corporate Philanthropy Awards 2023: Read how BJC HealthCare funnels capital into north St. Louis with help from Midwest BankCentre.

Watch how Midwest BankCentre partnered to transform the community of Pagedale, MO through Impact Banking.

Discover the power of Impact Banking.

By Impact Banking with Midwest BankCentre, you gain a trusted financial partner while your dollars do more for our region’s most vulnerable — transforming lives and communities equitably, so we all RISE TOGETHER.